How To Increase Your Apple Card Credit Limit

You want to buy something (a new iPhone?) and your credit card limit is not enough to buy it? Your Apple Card limit is the maximum amount that you can spend using your card before you need to pay off some of your balance. You may want to increase your limit for various reasons. For example, increasing your credit limit could improve your buying power and your credit score. This short article explains how you can increase your Apple Card credit limit:

See also: App Store Keeps Asking For Credit Card Info? Fix

Increase Apple Card limit:

1. Open the Wallet app on your iPhone and tap Apple Card.

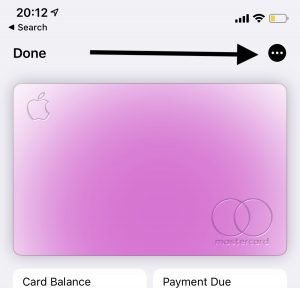

2. Tap the more (…) button (in the top right corner).

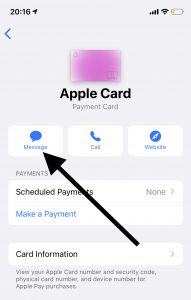

3. Tap the Message icon, this will let you start chatting with an Apple Card Specialist.

4. Request a credit limit increase. Just tell you’d like to request a credit limit increase. Your request for a limit increase will be reviewed by Goldman Sachs.

There is no guarantee that your limit will be increased. But the worst they can say is no.

Your credit limit is determined using your credit history and your credit score.

To increase your chances, you may try the following:

- Pay your Apple Card balance on time every month.

- Pay more than your minimum payment requirement.

- If your card is pretty new, then, probably, your request will not be approved.

Apple will inform you of its decisions with a letter.

See also: Apple ID scams

How to view your current limit:

You can easily view your current limit. Here is how:

1. Open the Wallet app on your iPhone and tap Apple Card.

2. Tap the more (…) icon.

3. Scroll down and find the Credit Details section. You can see your credit limit.

Note: A limit increase request may trigger a hard pull on your credit report which may negatively affect your credit score.

See this article if you want to cancel your Apple Card.

applied for the card, was approved 5000$, after 91 days requested cli via chat, in 5 seconds they approved and raised to 8000$.

Apple is the best, in less than 10 seconds my credit limit increased. they are amazing, the best …

Just followed the instructions above and within seconds I was connected to Goldman Sachs chat. They texted me a link to enter my annual salary and the second I was done, GS sent an instant CLI approval text with the amount. Went from $6500 to $8000. I’ve had the Apple Card for 1.2yrs and this was my first CLI request. The entire process was under 10 seconds.

-Pay my balance off each month.

-No late pmts

-Soft pull

-Instant approval

Painless experience. Asked for an increase, got a quick form asking to provide my annual income. Did it and immidiately got increase from 7500 to 11500; shoulda done it earlier.

This definitely works. I tried it right now and got a credit increase by $1000 in less than a minute.

I can also confirm this is false. I just successfully requested a CLI through the chat app. It couldn’t be more simple.

I requested an increase 6 months after getting the card. Credit was above 700. Denied for some vague reasons.

I just did it through the chat. went from $8500 to $11,500 as soon as the chat was closed. They told me anywhere from 10 minutes to 3 days.

I just did this and I was pretty bummed, because it said I had to wait 3 days for an answer and on my other cards that usually meant a denial. A minute later I went back and my limit went from 4,000 to 5,500. Heck yes I’ll take it.

It worked for me. They transferred me to a manager at Goldmansachs and I put my request in with them and they said to wait 3 days for the resolution.

Worked for me too! They said 3-5 days, but got a 3k increase 20 seconds later!

How long have you had your card for.

This no longer works – Just contacted them via this method for an increase and they said I had to contact Goldman Sachs and provided the contact info.

Not true, I just requested a CLI via chat, and got it in 2 mintues! Soft Pull by the way