How to Access Your Apple Savings Account Tax Documents (1099)

Apple introduced a high-yield savings account to its product list in early 2023. Apple offers high interest with no fees or minimum balance requirements, which can be managed through the Wallet app. This savings account is part of Apple Card and is exclusively for Apple Card owners or co-owners. This also means that you need to be an iPhone user.

The Apple Savings account has become very popular. Last August, Apple said that the account had reached more than $10 billion in deposits since its launch. Opening an Apple Savings account is pretty simple and takes only minutes.

Interest income, including that from savings accounts, is taxable; thus, you need to report it when you file your taxes. If you have deposited money into an Apple Savings account, Apple will prepare and send a Form 1099-INT by January 31, assuming that you were paid $10 or more in interest. You can access your existing tax documents using your iPhone whenever you’d like. In this article, I explain how to obtain your Apple Savings tax documents.

How to access your Apple Savings tax documents

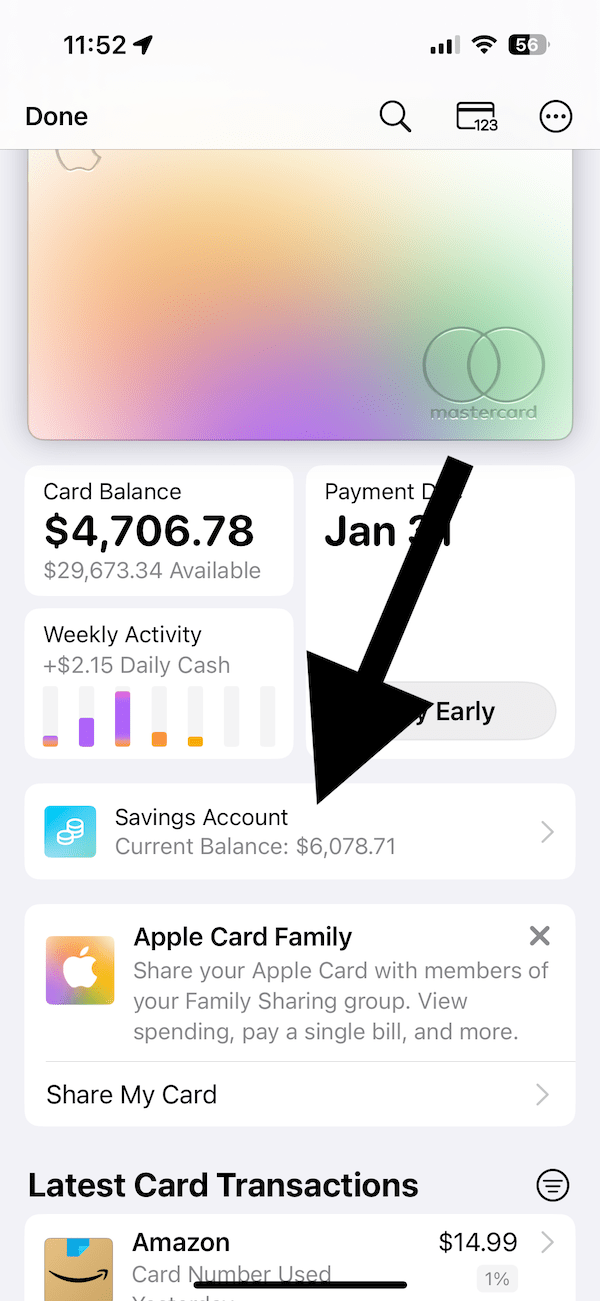

- Open the Wallet app on your iPhone.

- Tap your Apple Card.

- Tap Savings Account in the middle of the screen.

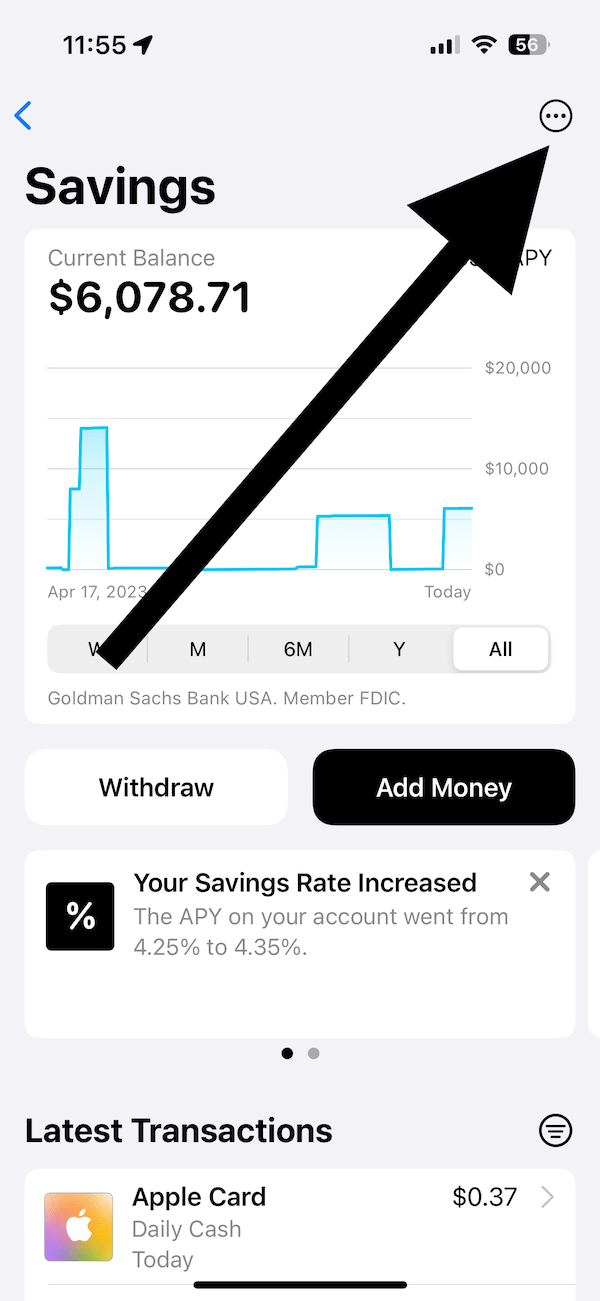

- Tap the more (…) button located in the top-right corner of the screen.

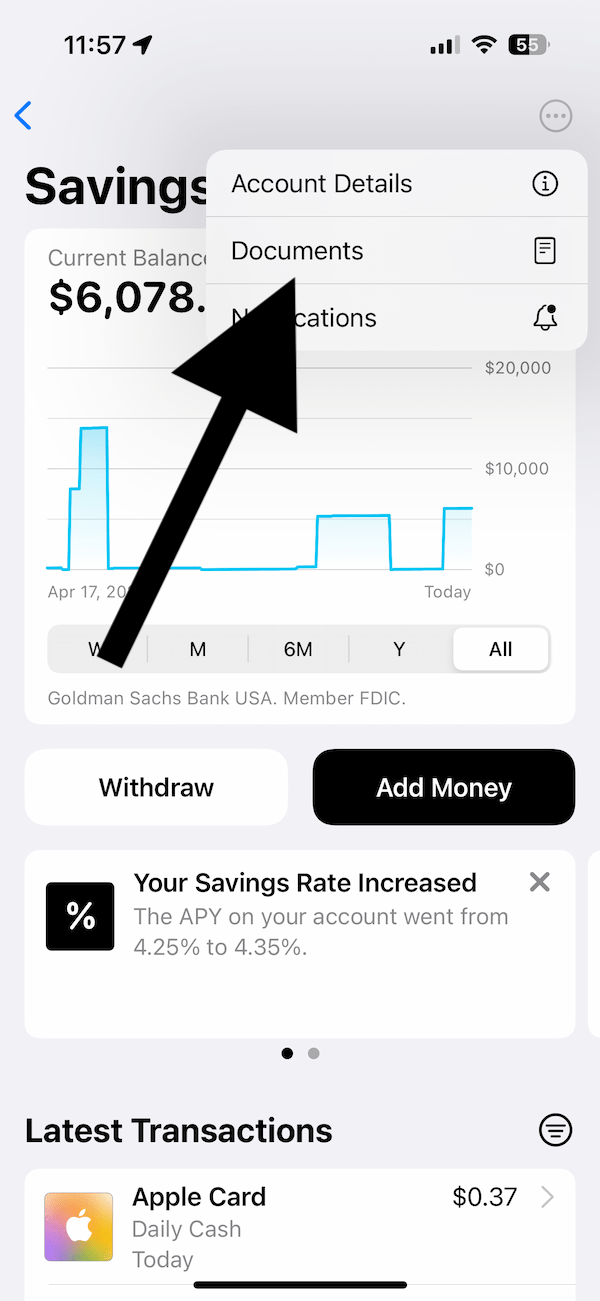

- A menu will open. Tap Documents.

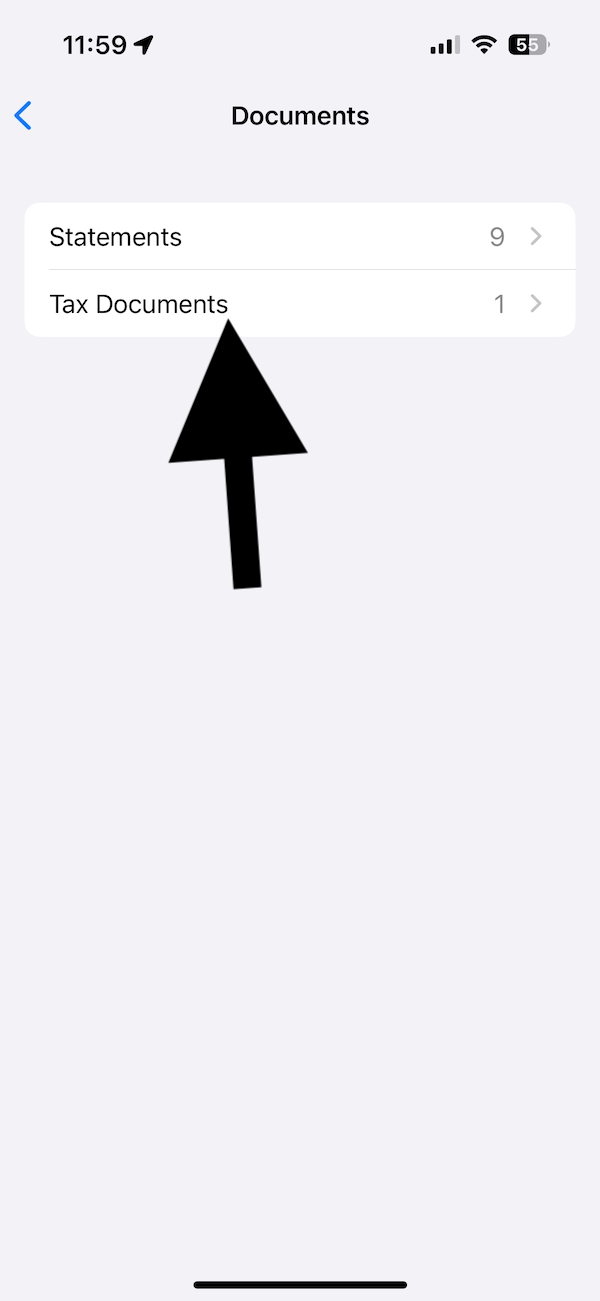

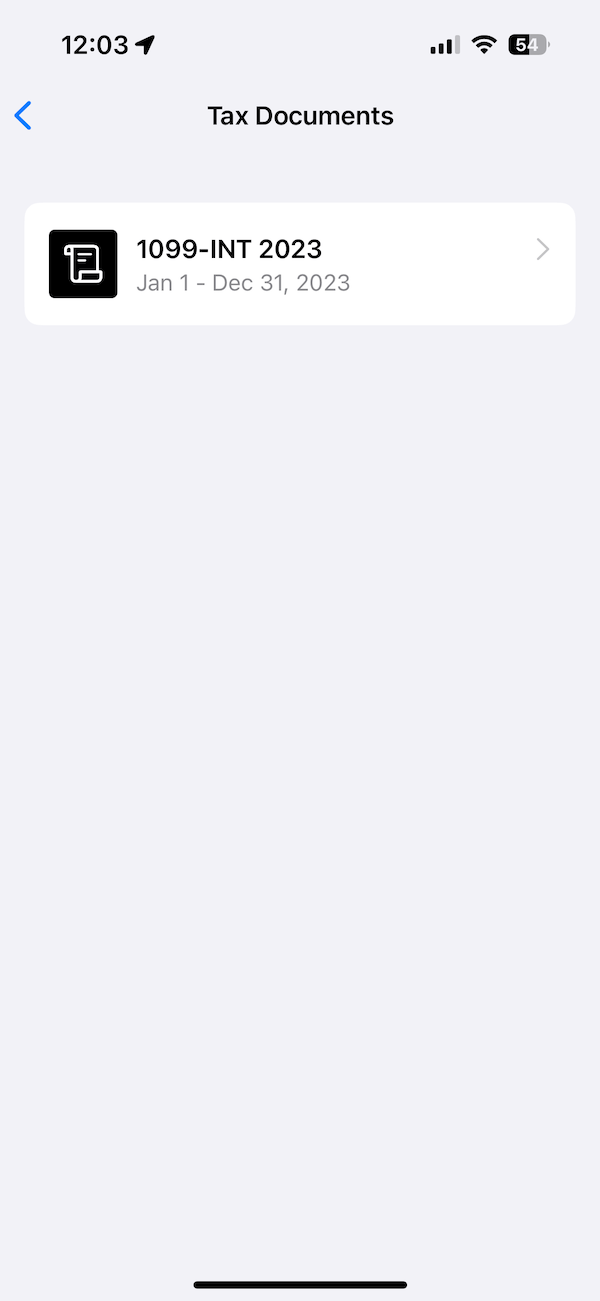

- Tap Tax Documents.

- Then, you can see your 1099-INT documents for the year 2023. This is the first year that Apple is issuing tax documents for the savings account. Thus, there will only be one tax document. But in the future, you may see more tax documents for different years.

- Tap your tax document to open it. You will need to authenticate with Face ID or Touch ID to open your tax document. After you open it, you can share it with your accountant or others by tapping the Share button.

If you are no longer using your iPhone (e.g., you switched to Android), or you are no longer an Apple Savings account customer, you will still be able to get your tax document by contacting Apple Support for the Savings account. The Savings account support number is 1-877-255-5923.

Your 1099-INT form will show how much interest you earned during the previous year. You can use this form when you or your accountant files your taxes.

If you go to the card.apple.com website, tax documents are not available there, but you can access your Apple Card statements.

Apple’s Savings account’s interest rate is competitive but not the highest. Apple’s current interest rate is at 4.35% APY (annual percentage yield), but there are other places offering even higher annual percentage yields. Some banks offer interest rates above 5%.

However, Apple Savings has other advantages. For example, your Apple Cash can automatically be deposited there. You should also note that Apple Cash earnings are not considered interest income.

To put it into perspective, a $10,000 deposit will earn about $444 in interest after one year in an Apple Savings account at 4.35 APY. Of course, interest rates do not stay the same; they may change. In fact, Apple’s original rate was 4.15 APY and then gradually increased to 4.35.

If you want to open an Apple Savings account, open your Apple Card in the Wallet app, tap the More button with three dots at the top of the screen, tap Daily Cash, select Set Up Savings, and then follow the onscreen instructions.

Related articles